@linavexleymb

プロフィール

登録日: 3週、 4日前

XM Account Comparison: Micro, Standard & Zero Accounts Choosing the right trading account is one of the most important decisions for any Forex trader. XM is a well-known global broker offering multiple account options designed to suit different experience levels and trading styles. In this guide, we provide a detailed comparison of XM’s Micro, Standard, and Zero accounts to help traders understand their key differences, costs, and suitability. This article is published for educational purposes by Mbroker.net, aiming to support traders in making informed decisions. Introduction to XM Trading Accounts XM has built a strong reputation in the online trading industry by offering flexible trading conditions, transparent pricing, and multiple account choices. Rather than using a one-size-fits-all approach, XM allows traders to select an account that aligns with their capital size, risk tolerance, and strategy. Whether you are just starting out or trading actively every day, understanding how each account works can significantly impact your trading performance. This XM account comparison focuses on three main options: Micro, Standard, and Zero. Each account type offers different contract sizes, pricing models, and cost structures, making them suitable for specific trader profiles. Overview of XM Account Types XM Account Types are structured to accommodate traders at different stages of their journey. While all accounts provide access to the same trading platforms and instruments, the main differences lie in lot size, spreads, and commissions. The Micro account is designed for small-volume trading and risk control. The Standard account provides a balanced setup for most retail traders. The Zero account, on the other hand, focuses on ultra-low spreads and is often preferred by experienced traders who prioritize execution costs. Understanding these differences is essential before committing capital, as the wrong account type may increase costs or limit your strategy. XM Micro Account – Best for Beginners The XM Micro account is widely regarded as the most beginner-friendly option. It allows traders to enter the market with minimal exposure and better risk management. Key Features of the XM Micro Account Contract size: 1 lot equals 1,000 units Lower position sizing for precise control Access to Forex, indices, commodities, and more Same leverage options as other XM accounts Pros and Cons of the XM Micro Account Pros Ideal for new traders learning the market Smaller lot sizes reduce potential losses Suitable for testing strategies in live conditions Cons Less efficient for high-volume trading Profit potential is lower compared to larger lot sizes Who Should Choose the XM Micro Account? This account is best for beginners, cautious traders, and those transitioning from demo to live trading. It is also suitable for traders who want to fine-tune strategies with real market execution but minimal risk. Read more: https://linavexleymb.muragon.com/entry/2.html XM Standard Account – Balanced Choice for Most Traders The XM Standard account is the most commonly used option among retail traders. It offers a good balance between flexibility and trading efficiency. Key Features of the XM Standard Account Contract size: 1 lot equals 100,000 units Competitive spreads with no commission Broad access to trading instruments Suitable for both short-term and long-term trading Pros and Cons of the XM Standard Account Pros Simple pricing with spread-only costs Efficient for moderate to high-volume traders No restrictions on trading strategies Cons Spreads are wider than Zero accounts Less precise position sizing than Micro accounts Who Should Use the XM Standard Account? This account is ideal for intermediate traders who have some experience and want to trade standard lot sizes without paying commissions. It suits swing traders, position traders, and even day traders who prefer straightforward pricing. XM Zero Account – Low Spread Trading The XM Zero account is designed for traders who focus on cost efficiency and fast execution. It uses a raw spread model combined with a small commission. Key Features of the XM Zero Account Spreads from 0.0 pips on major pairs Fixed commission per lot High-quality execution and liquidity Suitable for scalping and active trading Pros and Cons of the XM Zero Account Pros Extremely tight spreads Lower overall costs for frequent traders Ideal for technical and short-term strategies Cons Commission adds complexity to cost calculation Less suitable for beginners Who Is the XM Zero Account Best For? This account is best suited for professional traders, scalpers, and day traders who execute multiple trades per session and rely on minimal spread costs. Choosing the Right XM Account The best XM account depends on your experience level, capital size, and strategy. Beginners usually benefit from Micro accounts, most retail traders prefer Standard accounts, and advanced traders often choose Zero accounts for lower trading costs. For a broader evaluation of XM’s overall trading environment, regulation, and reliability, traders may want to consult a detailed XM Broker Review before opening an account. Final Verdict XM offers a flexible account structure that caters to nearly every type of trader. By understanding the strengths and limitations of each option, traders can select an account that supports their goals and trading style. Making the right choice from the beginning can improve risk management, reduce costs, and enhance overall trading performance.

サイト: https://mbroker.net/author/lina/

フォーラム

開始したトピック: 0

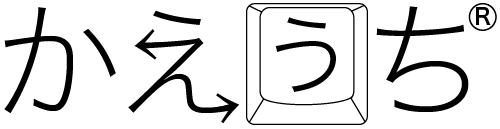

返信: 0

フォーラム権限グループ: 参加者